General |

Twelve Cupcakes Sudden Closure: What Workers in Singapore Need to Know

The Shock of Closure: What Happened?

Singapore’s well known dessert chain Twelve Cupcakes made headlines after its sudden closure on 29 October 2025 and move into provisional liquidation. Employees reportedly received little notice before outlets were shuttered and operations ceased. Liquidators have since been appointed to take control of the company’s remaining assets and liabilities.

For many affected workers, this abrupt closure has raised urgent questions. What are my rights? How can I recover my unpaid salary? What happens next?

This situation highlights an important issue that every employee should understand: what happens to employment contracts, wages, and benefits when a company enters liquidation in Singapore.

Your Rights as an Employee in Singapore

When a company shuts down suddenly or enters liquidation, employees are not left entirely without legal recourse. Singapore law sets out certain rights and priority rules that may allow employees to recover unpaid wages and benefits. Understanding how these legal mechanisms work helps workers take practical steps to maximise their chances of recovery, even though full payment is not guaranteed.

The Employment Act

The Employment Act is Singapore’s primary labour legislation and covers most employees, except certain senior managerial, executive, or seafaring roles. It governs key employment matters such as:

- Salary payment obligations

- Leave entitlements

- Notice periods

- Termination rights

When a company goes into liquidation, employees are still legally entitled to wages and benefits that have already been earned. However, actual recovery depends on the company’s available assets and how those assets are distributed during liquidation.

Understanding Company Liquidation and Its Impact on Employees

When a company like Twelve Cupcakes can no longer meet its financial obligations, it may be placed into liquidation, also known as winding up.

What Is Liquidation?

Liquidation is the legal process of bringing a company’s existence to an end by:

- Collecting and selling its assets;

- Converting those assets into cash; and

- Distributing the proceeds to creditors in a legally prescribed order

Once the liquidation process is completed, the company is dissolved and ceases to exist as a legal entity.

The process is governed by the Insolvency, Restructuring and Dissolution Act 2018, known as the IRDA.

The Role of the Liquidator

Once a company enters liquidation, control of the business shifts from its directors to an independent liquidator.

The liquidator plays a central role and is responsible for:

- Taking custody and control of all company assets

- Investigating the company’s financial affairs and past transactions

- Selling assets to generate funds

- Verifying and admitting creditor claims, including employee claims

- Distributing available funds according to the statutory priority rules under the IRDA

- Reporting to creditors and, where required, the court

For employees, the liquidator is the key point of contact. All claims for unpaid salary, leave pay, or other employment entitlements must be submitted to the liquidator, usually by way of a Proof of Debt form. The liquidator assesses each claim and determines whether and how much can be paid.

How Liquidation Affects Employees

1. Termination of Employment

In most cases, liquidation results in the automatic termination of employment, unless the liquidator decides to retain certain employees temporarily to assist with closing operations or asset realisation.

This termination is not disciplinary. It occurs because the company is no longer able to continue its business.

2. Employees Become Creditors

Once employment ends, employees become creditors of the company. To recover unpaid wages or benefits, employees must submit their claims to the liquidator.

Claims that are not filed or properly documented may not be paid.

3. Priority of Payment for Employees

Employees are classified as preferential creditors under Section 203 of the IRDA. This means they are paid ahead of ordinary unsecured creditors such as suppliers, but after certain higher priority claims.

Employee claims are subject to statutory caps.

4. CPF Contributions

Unpaid CPF contributions for up to 12 months before liquidation are also treated as preferential debts. Employees should check their CPF statements and may seek assistance from the CPF Board if contributions are missing.

Who Gets Paid First in a Liquidation?

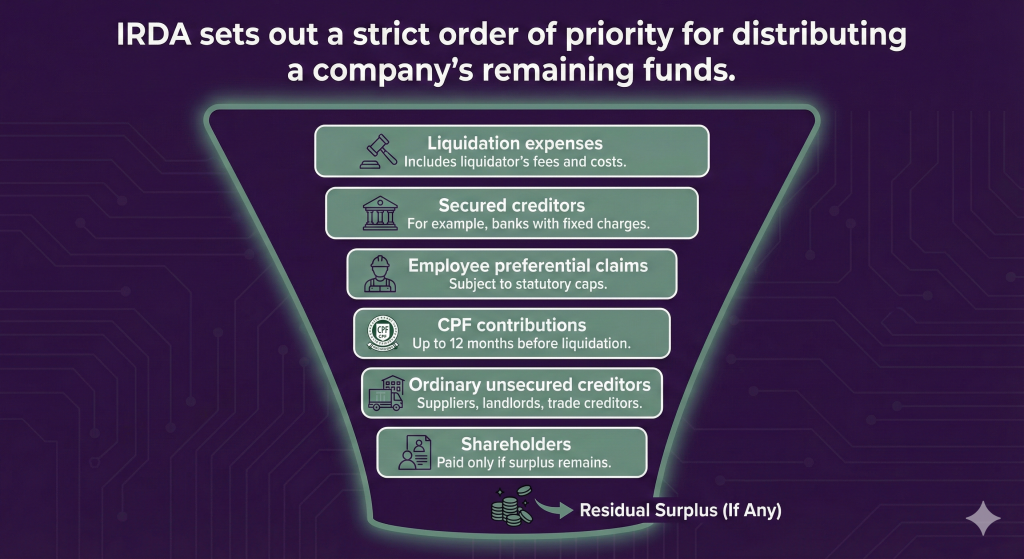

The IRDA sets out a strict order of priority for distributing a company’s remaining funds.

Order of Priority in Liquidation

| Priority Level | Type of Claim | Description |

| 1 | Liquidation expenses | Includes liquidator’s fees and costs |

| 2 | Secured creditors | For example, banks with fixed charges |

| 3 | Employee preferential claims | Subject to statutory caps |

| 4 | CPF contributions | Up to 12 months before liquidation |

| 5 | Ordinary unsecured creditors | Suppliers, landlords, trade creditors |

| 6 | Shareholders | Paid only if surplus remains |

Example: How $100,000 Is Distributed post Liquidation

Assume a company in liquidation has only $100,000 available after selling all its assets.

- Liquidation expenses: $20,000

- Secured creditor (bank loan): $50,000

- Employee claims for unpaid salary: $60,000 (within statutory caps)

Distribution would work as follows:

| Step | Payment | Remaining Balance |

| Start | Total available funds | $100,000 |

| 1 | Liquidation expenses paid | $80,000 |

| 2 | Secured creditor paid | $30,000 |

| 3 | Employee claims paid | $30,000 |

| 4 | Unsecured creditors | $0 |

In this scenario, employees receive only part of what they are owed, even though they rank ahead of ordinary unsecured creditors. Payment depends entirely on how much money remains after higher priority claims are settled.

How to Claim Unpaid Salary and Other Dues

This is the most important section for affected employees.

Step 1: Gather Your Documents

Prepare the following:

- Employment contract

- Payslips or bank statements

- Termination or closure notices

- Identification documents

These documents support your claim and help the liquidator verify amounts owed.

Step 2: Contact the Liquidator

The appointed liquidator is your primary point of contact. They will provide instructions for submitting your Proof of Debt and supporting documents. Keep copies of everything you submit.

Step 3: Seek Assistance from MOM

If there are delays or disputes regarding your wage claim, you may approach the Ministry of Manpower. MOM can assist with:

- Employment dispute mediation

- Referrals to the Employment Claims Tribunal

- Guidance on wage recovery during liquidation

Step 4: Mediation Through TADM

The Tripartite Alliance for Dispute Management, involving MOM, NTUC, and SNEF, provides mandatory mediation for many employment disputes before tribunal proceedings can begin.

Union Support

If you are a union member, seek assistance early. Unions can help coordinate claims, represent members in mediation, and provide additional legal and welfare support.

Seeking Further Assistance

If you are affected by a company liquidation in Singapore, consider reaching out to the following agencies:

| Agency | Role | Website |

| Ministry of Manpower | Employment rights and wage recovery | www.mom.gov.sg |

| Employment Claims Tribunal | Salary dispute adjudication | www.statecourts.gov.sg |

| Tripartite Alliance for Dispute Management | Employment dispute mediation | www.tal.sg/tadm |

Conclusion

The sudden closure of Twelve Cupcakes is a reminder that business failures can happen quickly and have serious consequences for employees. Liquidation is often uncertain and recovery is never guaranteed, but Singapore law does provide a structured process for employees to submit claims and seek payment from remaining assets.

If you are affected, act promptly. Document your claims, contact the liquidator, and seek help from MOM or your union where needed. While outcomes depend on available assets, timely action gives you the best chance of recovery.

Frequently Asked Questions

Will I get my unpaid salary during liquidation?

Employees are preferential creditors, but payment depends on available assets. Full recovery is not guaranteed.

How long does liquidation take?

Liquidation can take several months to several years depending on the complexity of the case, the number of claims, and how long asset realisation takes.

What if I am a foreign worker?

Foreign workers have the same wage protection rights. MOM can also assist with work pass and repatriation matters.

Can I start a new job while waiting for payment?

Yes. Once your employment has ended, you are free to seek new employment.

Delivering Solutions not just Answers to your legal disputes

We provide solutions to the table for all our clients regardless of the scale or complexity of the cases. Let us know how we can help.

Contact UsAny information of a legal nature in this blog is given in good faith and has been derived from resources believed to be reliable and accurate. The author of the information contained herein this blog does not give any warranty or accept any responsibility arising in any way, including by reason of negligence for any errors or omissions herein. Readers should seek independent legal advice.